Parts

Sort by:

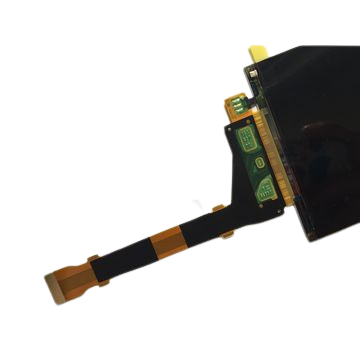

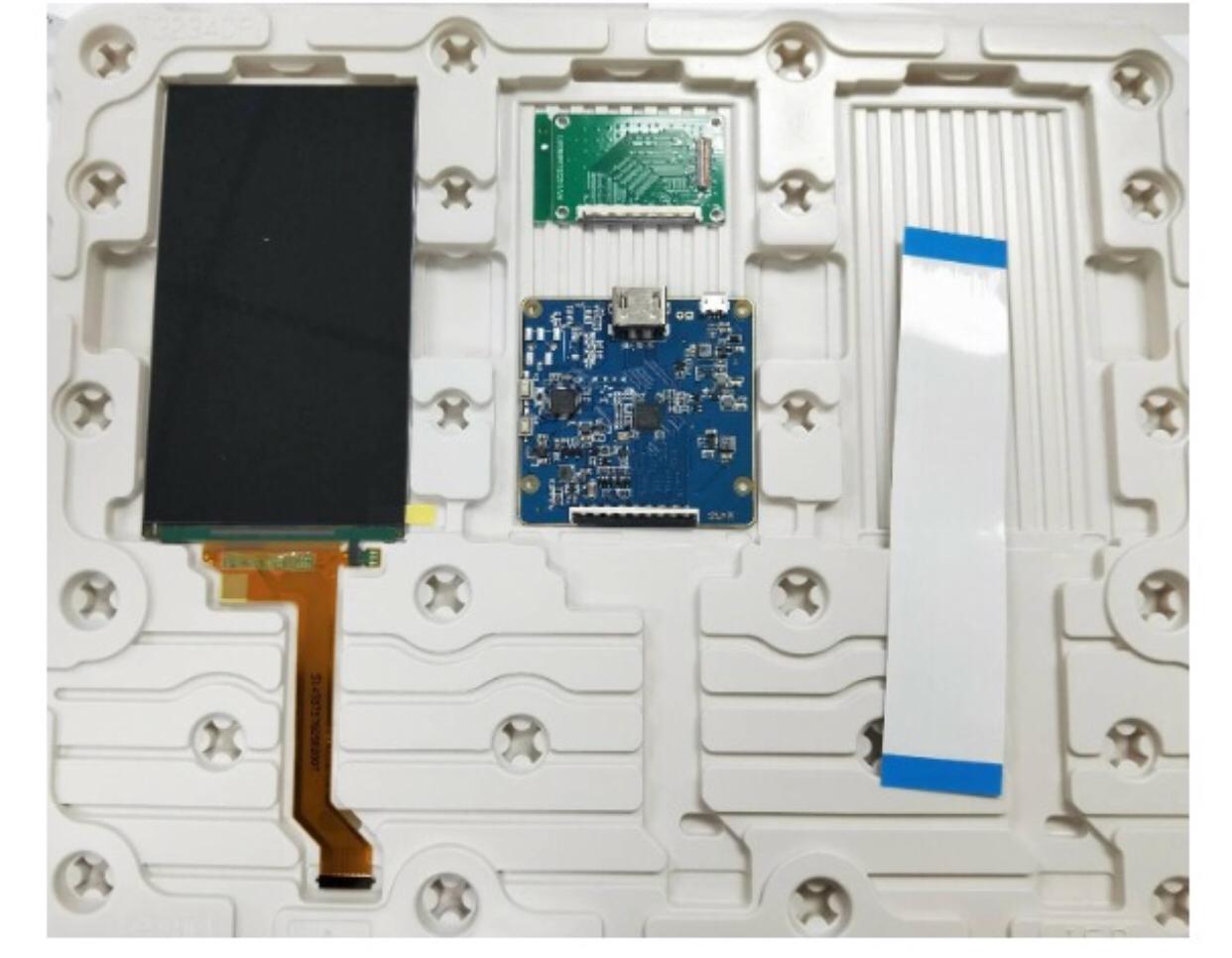

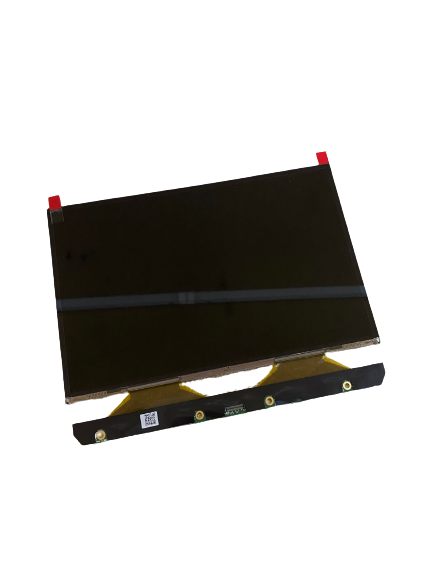

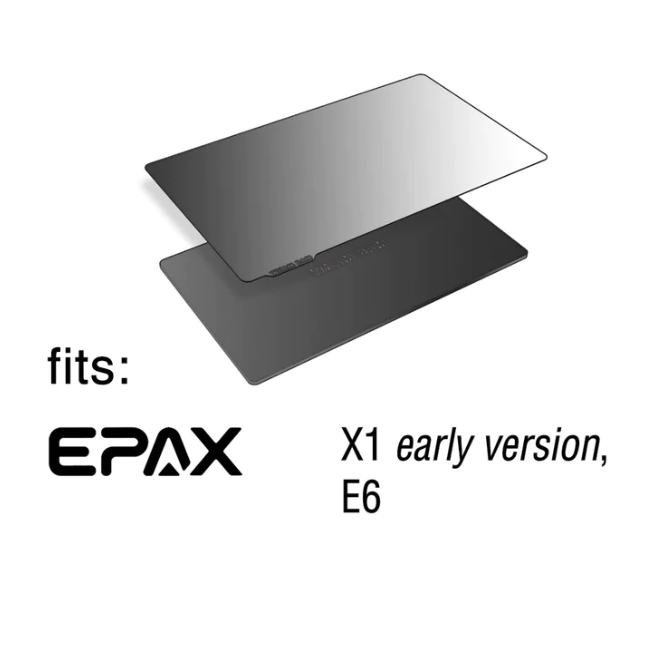

We offer many replacement parts for your 3D printer. Before buying, please, check if the part is compatible with the model of your 3D printer. Please read the specification and description mentioned on the product page carefully. If you have any doubts, contact us, and we will help you to find the part that you are looking for.

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- …

- 29

- 30

- >